In 1938, Congress enacted the Fair Labor Standards Act (FLSA) with the noble aim of eradicating labor conditions detrimental to the well-being of workers. This landmark legislation mandates that employers pay nonexempt employees at least the Federal minimum wage for all hours worked and compensate them at a rate of one and one-half times their regular pay for overtime.

Additionally, the act necessitates covered employers to maintain specific employee records and prohibits retaliation against those who raise concerns about their pay.

However, the FLSA's protections do not extend to independent contractors, and the act does not offer a clear definition of "independent contractor." Instead, it provides definitions for "employer," "employee," and "employ," leaving the interpretation of contractor status to regulatory agencies and courts.

Since the 1940s, the Department of Labor (DOL) and the judiciary have employed an economic reality test to distinguish between employees and independent contractors under the FLSA. This test scrutinizes whether a worker is economically reliant on the employer for employment (indicative of employee status) or operates autonomously (indicative of independent contractor status).

Factors considered in this assessment include the opportunity for profit or loss, investment, permanency, control, the integral nature of the work to the employer's business, and the level of skill and initiative required.

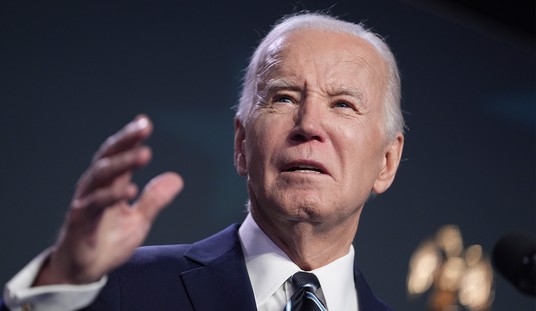

On January 10, the U.S. Department of Labor (DOL) issued its long-awaited final rule revising guidelines for classifying workers under the FLSA. This rule, effective from March 11, marks a significant departure from its predecessor, rescinding the previous independent contractor rule established in January 2021.

Unlike its predecessor, which focused primarily on a worker's control over their work and potential for profit or loss, the new rule adopts a more comprehensive approach, evaluating multiple factors to determine worker classification.

The final rule outlines six key factors employers should consider when classifying workers:

The worker’s potential for profit or loss based on managerial skills.

Investments made by both the worker and the potential employer.

The permanence of the working relationship and the worker’s ability to work for multiple entities.

The degree of control exerted by the potential employer.

The significance of the work performed to the potential employer's business.

The level of skill and initiative required for the work.

Importantly, the rule underscores that no single factor is determinative, and each case should be assessed individually, with the option to consider additional relevant factors.

While the final rule provides clarity on the DOL's stance regarding worker classification, its implications for various industries, particularly transportation, are profoundly negative.

Many truck drivers, traditionally classified as independent contractors, may find it challenging to maintain this status under the new rule, given factors such as investment in equipment and the use of specialized skills. It puts fleet health and safety at risk, and may well put truckers out of their jobs.

In an interview with Jill Snyder, Compliance and Safety Director at Zonar Systems, Snyder said, “Without altering the current USDOL IC Rule, America is going to see a greater truck driver shortage, as these hard-working Americans lose their jobs; reduced capacity to transport goods; and higher inflation due to higher transportation costs and shortage of goods.”

The Intermodal Association of North America (IANA) has raised concerns about the rule's potential impact on the classification of intermodal drayage drivers, noting that over 80 percent of them currently operate as independent contractors. According to IANA President and CEO Joni Casey, these drivers deliberately choose the freedom and flexibility of independent contractor status, rejecting employee positions readily available to them. IANA and other transportation organizations support legislation to halt the rule’s implementation.

The American Trucking Associations (ATA) has expressed staunch opposition to the new rules, asserting that they infringe upon individuals' freedom to choose work arrangements that align with their needs and aspirations. ATA President and CEO Chris Spear contends that independent contractor status offers economic opportunity and flexibility to over 350,000 truckers, and the rule's complexity undermines their livelihoods and weakens the supply chain.

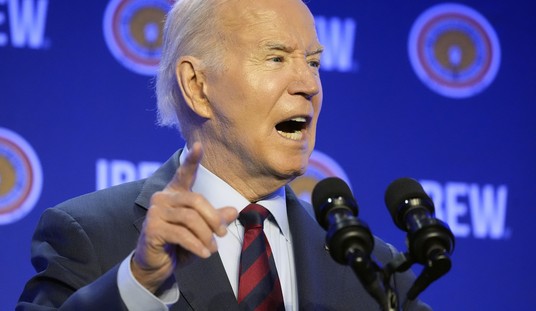

Todd Spencer, President of the Owner-Operator Independent Drivers Association (OOIDA), highlights the uncertainty created by changing regulations, which makes it challenging for truckers to operate their businesses effectively. “As we said when the Biden administration first issued this proposal, we have concerns that some details contained in the rule may disregard specifics of the trucking industry and could lead to the reclassification of independent contractors as employees.”

While OOIDA acknowledges the DOL's intent to follow established practices for classification under the FLSA, it remains concerned that certain aspects of the rule may overlook the unique dynamics of the trucking industry and lead to widespread reclassification of independent contractors as employees.

Once again, government proves that its alleged attempts to help the little guy only serve one purpose: to make things worse. The independent contractors themselves aren’t complaining. With an ongoing driver shortage, contractors have multiple companies to choose from if they wanted to be classified as employees. They obviously prefer the independent approach.

The more cynical among us might read this as part of a two-step process by Democrats to enhance union membership. First, independent contractors must be eliminated and forced into becoming employees. Once they are employees, then the unions can attempt to organize them.

The irony, of course, is that the entire 20,000-employee base of Yellow Corporation belonged to the Teamsters. It was labor issues and demands of the union that forced Yellow into bankruptcy.

RELATED:

KILEY: The American Dream Is in Danger

A Lawsuit Seeks to Stop the National Destruction of Trucking Through the DOL Indep. Contractor Rule

Robert Morton is a media, financial, and policy analyst whose research expertise includes Hollywood, the credit markets, and COVID-19 data.

Join the conversation as a VIP Member