In 2010, Congress passed the Dodd-Frank Act, which created the new “Bureau of Consumer Financial Protection (CFPB),” an all-powerful agency vested with the power to limit the choices of consumers in financial markets, making it harder and more expensive to obtain credit. This unaccountable agency operates autonomously within the Federal Reserve and will not be subjected to congressional appropriations or oversight.

Yesterday, the CFPB announced its new statist mandates on mortgage lending institutions and banks, limiting the ability of people to obtain mortgages. Here is the gist of it from CQ (subscription required):

Under the proposed rule, lenders would have to examine consumers’ financial information, including employment status, income and assets, debt and credit history. Lenders could not offer loans with little or no documentation, which was a hallmark of the subprime era.

Borrowers would need to have sufficient assets or income to repay their loan. Lenders would be required to evaluate a borrower’s long-term ability to repay, rather than simply the ability to do so during an initial period.

The rule would set new underwriting standards that lenders would have to meet in order for loans to be considered “qualified mortgages,” a status that provides some protection against future liability. Going forward, the new standard is expected to largely define the type of mortgages that will be available.

For a mortgage to be qualified, it cannot require the borrower to pay excessive points or include risky features. Those would include a term longer than 30 years, interest-only payments or negative-amortization payments that increase the principal amount of the loan.

In an effort to ensure that consumers are able to meet financial obligations in addition to homeownership, qualified mortgages will generally be unavailable to people with debt-to-income ratios greater than 43 percent.

Sounds pretty much like commonsense, right? Banks should only lend to those who have the ability to pay it back. So why would banks need these new regulations?

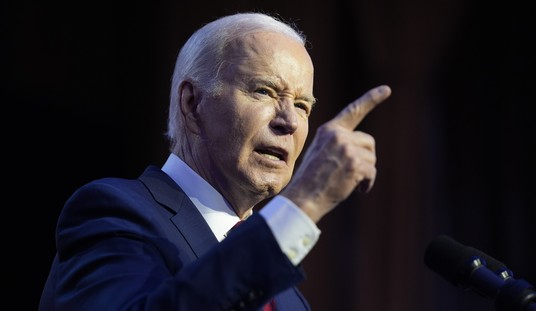

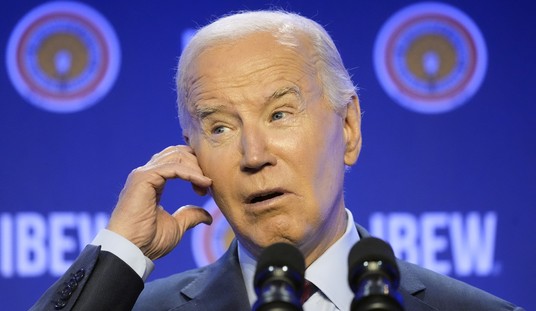

This is a consummate example of the arsonist acting like the firefighter. Obama’s allies fought for years to create entire offices and programs dedicated to forcing banks to underwrite risky mortgages under the dubious goal of universal home ownership. Concurrently, Fannie Mae and Freddie Mac bought up the lion’s share of the subprime mortgage securities and fueled the toxic asset bubble. The bubble popped, bringing down the entire economy with it.

All we have to show for it is $140 billion in taxpayer bailouts for Freddie/Fannie and a $16.3 billion shortfall at the Federal Housing Administration.

When Obama was a young community organizer, he made a lot of money off instigating lawsuits against banks for so-called “red-lining.” In addition, let’s not forget that he is a big fan of the Community Reinvestment Act, which is the catalyst for risky mortgages.

Yesterday, I caught up with Congressman David Schweikert (R-AZ), who sat on the Financial Services subcommittee with jurisdiction over housing policy in last Congress. He is not impressed with Obama’s sudden aversion to risky loans. “It is incomprehensible to me how the President can support a program like the Community Reinvestment Act. This government litmus test, amended during the Clinton Administration, played a key role in the housing market crash five years ago. How much more proof do we need to see that the President continues to take us down the wrong path to recovery?”

Additionally, Obama has championed the HAMP (Home Affordable Modification Program) and HARP (Home Affordable Refinance Program) programs, which provide refinancing to high-risk underwater applicants. He backs the Menendez bill, which would essentially open the floodgates on refinancing by eliminating most of the already lax qualifications for refinancing currently in place.

And evidently, he has no problems with 3% down loans from the FHA, so long as the taxpayer is shouldering the risk.

Obama is forcing private institutions to abide by guidelines that are antithetical to the goals he has pursued through government and as a community organizer – the very goals that have encouraged and coerced banks to engage in risky lending practices for years.

What’s next? Will he hire Barney Frank to be the next housing czar?

Join the conversation as a VIP Member