Even though the US Export-Import Bank is in grave political trouble, many political heavyweights are heavily invested in its success. The reason is obvious. The Export-Import Bank represents the worst aspects of crony capitalism and some of its largest benefactors are also major political donors.

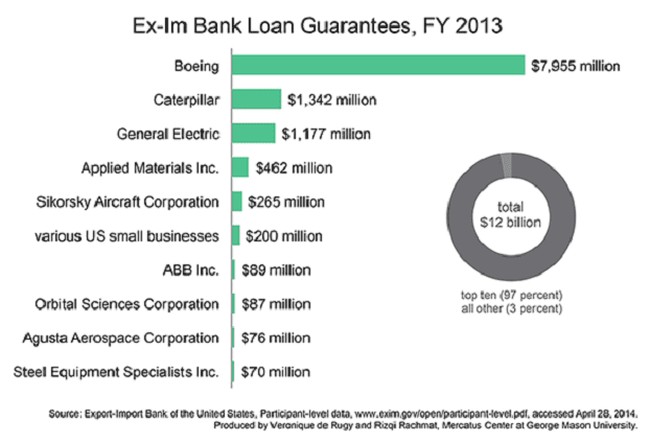

The US Chamber of Commerce, a firm ally of such loci of corruption as Thad Cochran and Mitch McConnell is claiming that some 200,000 US jobs are utterly dependent upon taxpayer subsidized loans as the products are so inferior or needlessly expensive that no one would buy them were it not for government subsidies. Though the Chamber touts the Export Import Bank as benefitting small businesses, 93% of all Export-Import Bank loans go to just ten corporations. Boeing, Caterpillar, and General Electric are the top three favored companies.

Keep the names of these companies in mind as you read on.

In fact, the Export-Import Bank can cost US jobs while creating jobs in other countries.

Last year, Caterpillar sought Export-Import Bank loans to finance a deal to supply the huge Roy Hill iron project in Australia with equipment. In December, the deal was sealed:

In a decision that will support thousands of U.S. jobs, the Export-Import Bank of the United States (Ex-Im Bank) has authorized a $694.4 million loan to Roy Hill Holdings of Australia contingent upon the purchase of U.S. mining and rail equipment from Caterpillar Inc., GE, and Atlas Copco.

According to Bank estimates derived from Departments of Commerce and Labor data and methodology, the credit will support 3,400 U.S. jobs across America. Furthermore, an estimated 20 percent of the job support will benefit small-business jobs.

“After a comprehensive review, the Bank determined that this transaction represents a significant opportunity for American exporters to create and sustain American jobs,” said Ex-Im Bank Chairman and President Fred P. Hochberg. “Our financing positions American companies on a level playing field so they can close the sales and expand their homegrown workforces. Projects this size can be difficult to finance—that’s where Ex-Im comes in. And I am proud that today’s action will support 3,400 jobs across the country, many of them at small businesses.”

Though the largest beneficiary was Caterpillar ($522 million) the next biggest winner was… you guessed it… General Electric which was to supply locomotives and other ancillary equipment.

A large international company based in Cleveland, OH, called Cliffs Natural Resources either owns or has substantial interests in five iron mines in the United States. Cliffs Natural Resources objected to the sale because it, in effect, subsidized Australian iron ore and Asian steel:

It’s not that Minnesota’s congressional delegation doesn’t like Australia, mate. But the idea of a U.S. government bank loaning money to an Australian iron ore mine that will compete with Minnesota taconite?

That’s what they don’t like.

U.S. Sens. Al Franken and Amy Klobuchar and U.S. Rep. Rick Nolan, all Minnesota Democrats, are on record opposing a plan in front of the U.S. Export-Import Bank to invest in equipment for the giant Roy Hill iron mine in Australia’s northwestern Outback.

The Export-Import Bank is considering a request for $650 million in long-term financing to aid the export of $522 million of U.S.-made mining equipment to mine and process ore at Roy Hill. The rest of the money could be going to install the U.S. equipment on site at the mine.

Cleveland-based Cliffs Natural Resources, with four mines in Minnesota and Michigan, has led the charge to stop the loan, saying it threatens U.S. mining jobs and, with new Asian steel produced from Australian ore, eventually threatens U.S. steel industry jobs.

Caterpillar makes a counter argument, that at first blush looks plausible:

Caterpillar officials say the Roy Hill mine almost certainly will be built, with or without the U.S. loan. But without the loan, the equipment used in the mine probably would come from Korea or Japan.

“We’re hoping that the mine uses U.S.-produced equipment that is made by U.S. workers from steel made in the U.S., which happens to be made with iron ore from Minnesota and Michigan,” said Bill Lane, director of global government affairs for Caterpillar.

The $650 million contract to provide giant haul trucks, bulldozers, lift shovels and more “is a big deal” for Caterpillar — a huge contract that will spur jobs in places like Decatur, Aurora and East Peoria, Ill., and Milwaukee, and that’s moving Caterpillar to fight back against Cliffs.

Lane said that in coming days, Caterpillar will enlist members of Congress from Illinois and Wisconsin to weigh in in favor of the loan.

“Does the U.S. want Australia to use U.S.-produced products or Asian-produced products? That’s the simple question,” Lane said. “Frankly, we’re befuddled that there’s this opposition. … This (battle) is pitting Minnesota against Illinois and Michigan against Wisconsin, and that’s not good.”

Except, of course, that this argument is totally dishonest. The building of the mine is a non-issue. The source of the equipment is irrelevant. The whining by Caterpillar that they are not competitive without free government money should cause people to avert their eyes to avoid shaming Caterpillar rather than rush to their aid. The real issue is the US government, or one of its entities, determining winners and losers. The issue is the US government deciding that Caterpillar’s and GE’s bottom line and the jobs of their employees are more important than the bottom line of Cliff Natural Resources and the jobs of American iron miners on the Iron Range. In fact, the US government is obligating $650 million to support Caterpillar and GE in order to undercut US iron producers by $1.8 billion. Effectively, this deal costs the US companies $1.1 billion. And we get to pay for the privilege.

The Export-Import Bank is an anachronism that needs to be allowed to go out of business.

Join the conversation as a VIP Member