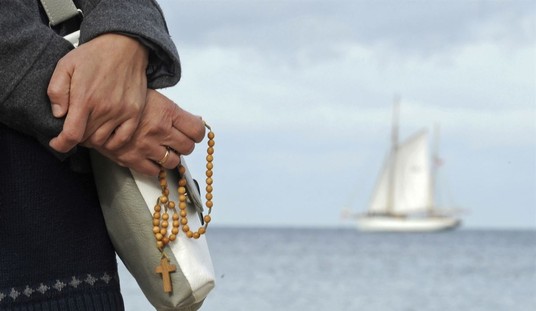

A faithful waves a Chinese flag as Pope Francis arrives for his weekly general audience in St. Peter’s Square at the Vatican, Wednesday, June 6, 2018. (AP Photo/Gregorio Borgia)

China represents an existential threat to the national security of the US in terms of growth of military capabilities but more importantly in the economic realm as they pursue their “Made in China 2025” and Belt-Road initiatives. The purpose of this series is to present the contents of one of those reports in “bite-sized chunks” that are more easily digestible in order to convey a better understanding of the Chinese economy and its long-term challenges to the US and the world.

Part I introduced and summarized the Congressional Research Service report, “China’s Economic Rise: History, Trends, Challenges, and Implications for the United States,” which forms the basis for this thread series. Part I can be found here. This part covers the history of China’s economic development.

Prior to 1979, China, under the leadership of Chairman Mao Zedong, maintained a centrally planned, or command, economy. A large share of the country’s economic output was directed and controlled by the state, which set production goals, controlled prices, and allocated resources throughout most of the economy. During the 1950s, all of China’s individual household farms were collectivized into large communes. To support rapid industrialization, the central government undertook large-scale investments in physical and human capital during the 1960s and 1970s. As a result, by 1978 nearly three-fourths of industrial production was produced by centrally controlled, state-owned enterprises (SOEs), according to centrally planned output targets. Private enterprises and foreign-invested firms were generally barred.

A central goal of the Chinese government was to make China’s economy relatively self-sufficient. Foreign trade was generally limited to obtaining those goods that could not be made or obtained in China. Such policies created distortions in the economy. Since most aspects of the economy were managed and run by the central government, there were no market mechanisms to efficiently allocate resources, and thus there were few incentives for firms, workers, and farmers to become more productive or be concerned with the quality of what they produced (since they were mainly focused on production goals set by the government).

According to Chinese government statistics, China’s real GDP grew at an average annual rate of 6.7% from 1953 to 1978, although the accuracy of these data has been questioned by many analysts, some of whom contend that during this period, Chinese government officials (especially at the subnational levels) often exaggerated production levels for a variety of political reasons.

Economist Angus Maddison puts China’s actual average annual real GDP growth during this period at about 4.4%.5 In addition, China’s economy suffered significant economic downturns during the leadership of Chairman Mao Zedong, including during the Great Leap Forward from 1958 to 1962 (which led to a massive famine and reportedly the deaths of up to 45 million people) and the Cultural Revolution from 1966 to 1976 (which caused widespread political chaos and greatly disrupted the economy).

From 1950 to 1978, China’s per capita GDP on a purchasing power parity (PPP) basis, a common measurement of a country’s living standards, doubled. However, from 1958 to 1962, Chinese living standards fell by 20.3%, and from 1966 to 1968, they dropped by 9.6%. In addition, the growth in Chinese living standards paled in comparison to those in the West, such as Japan, as indicated in this figure, which compares Chinese and Japanese per capita GDP, 1950-1978:

In 1978, (shortly after the death of Chairman Mao in 1976), the Chinese government decided to break with its Soviet-style economic policies by gradually reforming the economy according to free market principles and opening up trade and investment with the West, in the hope that this would significantly increase economic growth and raise living standards. As Chinese leader Deng Xiaoping, the architect of China’s economic reforms, put it: “Black cat, white cat, what does it matter what color the cat is as long as it catches mice?” Beginning in 1979, China launched several economic reforms. The central government-initiated price and ownership incentives for farmers, which enabled them to sell a portion of their crops on the free market. In addition, the government established four special economic zones along the coast for the purpose of attracting foreign investment, boosting exports, and importing high technology products into China.

Additional reforms, which followed in stages, sought to decentralize economic policymaking in several sectors, especially trade. Economic control of various enterprises was given to provincial and local governments, which were generally allowed to operate and compete on free market principles, rather than under the direction and guidance of state planning. In addition, citizens were encouraged to start their own businesses.

Additional coastal regions and cities were designated as open cities and development zones, which allowed them to experiment with free-market reforms and to offer tax and trade incentives to attract foreign investment. In addition, state price controls on a wide range of products were gradually eliminated. Trade liberalization was also a major key to China’s economic success. Removing trade barriers encouraged greater competition and attracted FDI inflows.

China’s gradual implementation of economic reforms sought to identify which policies produced favorable economic outcomes (and which did not) so that they could be implemented in other parts of the country, a process Deng Xiaoping reportedly referred to as “crossing the river by touching the stones.”

Since the introduction of economic reforms, China’s economy has grown substantially faster than during the pre-reform period, and, for the most part, has avoided major economic disruptions. From 1979 to 2018, China’s annual real GDP averaged 9.5%, as shown below.

This has meant that on average China has been able to double the size of its economy in real terms every eight years. The global economic slowdown, which began in 2008, had a significant impact on the Chinese economy.

China’s media reported in early 2009 that 20 million migrant workers had returned home after losing their jobs because of the financial crisis and that real GDP growth in the fourth quarter of 2008 had fallen to 6.8% year-on-year. The Chinese government responded by implementing a $586 billion economic stimulus package, aimed largely at funding infrastructure and loosening monetary policies to increase bank lending. Such policies enabled China to counter the effects of the sharp global fall in demand for Chinese products.

From 2008 to 2010, China’s real GDP growth averaged 9.7%. However, the rate of GDP growth declined slowed for the next six consecutive years, falling from 10.6% in 2010 to 6.7% in 2016. Real GDP ticked up to 6.8% in 2017, but slowed to 6.6% in 2018, (although it rose to 6.8% in 2017).

The IMF’s April 2019 World Economic Outlook projects that China’s real GDP growth will slow each year over the next six years, falling to 5.5% in 2024, as reflected in the below figure:

Many economists warn that China’s economic growth could slow further if the United States and China continue to impose punitive economic measures against each other, such the tariff hikes that have resulted from U.S. action under Section 301 and Chinese retaliation. The Organization for Economic and Cooperation and Development (OECD) projects that increased tariffs on all trade between the United States and China could reduce China’s real GDP in 2021-2022 by 1.1% relative to the OECD’s baseline economic projections.

Economists generally attribute much of China’s rapid economic growth to two main factors: large-scale capital investment (financed by large domestic savings and foreign investment) and rapid productivity growth. These two factors appear to have gone together hand in hand.

This ends Part II. In the next part of this series, we will examine those two factors, which are the main causes of China’s rapid economic growth.

Note: accurate estimates of Chinese economic growth are difficult for foreigners to ascertain, as the ChiComs are known to exaggerate performance in much the same manner that the Soviets did in order to “achieve the numbers” in their 5-year plans. In addition, the renminbi isn’t a convertible currency and is regularly manipulated by the Chicoms, which makes estimating real Chinese growth difficult to ascertain as noted here. Also, China’s financial services and real estate industries are opaque and, as many observers remark, “houses of cards” waiting to tumble down as discussed here. As such, the Chinese economy is highly vulnerable to external pressures, especially the imposition of US tariffs. Economic leverage works against China despite the caterwauling of globalists to the contrary. And if it’s one thing that President Trump understands, it’s the use of economic leverage in foreign policy!

The end.

Join the conversation as a VIP Member