Let’s forget the fact that Obama’s entire Stimulus 10.0 is a counterintuitive proposal that doubles down on the very failures that precipitated this speech. Let’s also disregard the fact that enshrining unemployment insurance as a permanent handout will perpetuate unemployment. And more union-induced, short-term money drops on infrastructure will do nothing but stimulate traffic jams. Let’s focus purely on the very numbers that the administration has offered –numbers that would undoubtedly be revised upward, if the plan is passed.

Total package – $447 billion

– 50% payroll tax cut for every employee, dropping the rate from 6.2% to 3.1%= $175 billion

-Obama also proposed cutting the employer payroll tax in half on the first $5 million of a firm’s payroll in 2012. About 98% of firms have payrolls of $5 million or less.= $70 billion

-National infrastructure bank = $10 billion

– Pork project handouts to unions for roads, rails and bridges= $50 billion

-An unprecedented extension of unemployment insurance benefits to be extended for another year, beyond the 99 weeks= $62 billion.

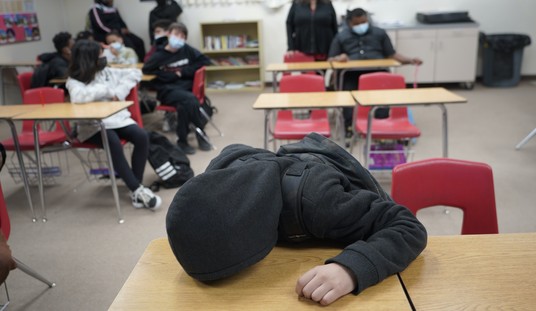

-Handouts to public school teacher unions, even though we already spend more per capita on education than any other country=$35 billion

-Refurbishing schools, a responsibility of local government=$25 billion

-Handouts to community colleges=$5 billion

–Rehabilitate vacant property=$15 billion

Despite the steep cost, Obama claims that it will all be paid for. How will he pay for it?

While he has failed to account for the source of revenue, he hinted to tax increases on rich people and closing oil company tax loopholes. But here is the kicker. As we’ve pointed out previously, the revenue from removing those oil company tax deductions would be a paltry $2 billion. The revenue from eliminating the so-called corporate tax deduction would be a miniscule $300 million!

To put this mathematical farce in another perspective; the entire revenue from corporate taxes in 2011 is estimated to be $192 billion. Yet, Obama plans to offset $447 billion worth of stimulus! He would need to drastically raise personal income rates to a crippling level, in order to accomplish that. Or, more likely, he will just increase the deficit.

Here’s another point: We all love tax cuts, but the payroll taxes are different because they are needed to pay for Social Security. Yet, Obama plans to cut revenues by $245 billion, or 36%, of the entire annual revenue (projected at $687 billion) of the so-called trust fund. Being that he will ostensibly slash half of payroll taxes, that number is surely too low (as is the estimate for unemployment benefits). So, Mr. President, if Social Security is really a pay-as-you-go system, how can you blithely raid the trust fund? Answer: #PonziScheme. Look who wants to get rid of Social Security now.

Meanwhile, Obama has blown through the entire $400 billion increase in the debt ceiling – in just one month. The debt now stands at $14.7 trillion. The Senate voted down a resolution of disapproval tonight, paving the road for another $500 debt increase. Hey, what’s another $447 billion among fellow socialists?

Join the conversation as a VIP Member