The opinions expressed in guest op-eds are those of the writer and do not necessarily represent the views of RedState.com.

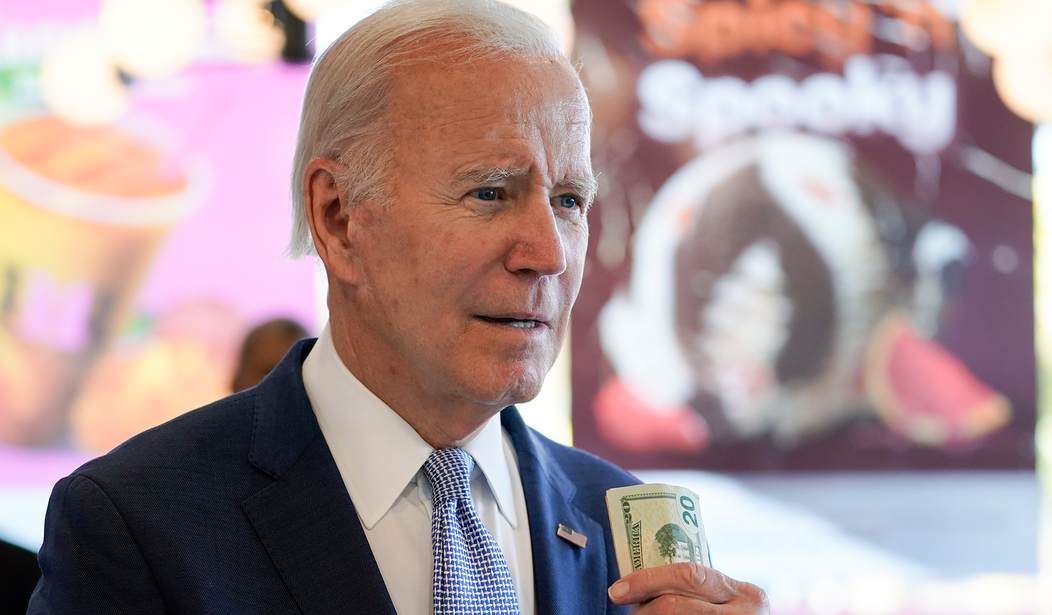

Suffice to say, the first two years under President Biden have not been the best economic times for the vast majority of Americans. From persistent inflation to government-induced shortages of essential goods like baby formula, life under the Biden administration has been quite a struggle for hard-working Americans.

The economic gloom due to Biden’s reckless spending and never-ending regulations has manifested throughout the economic spectrum. In fact, according to a new survey by Lending Club, a whopping 64 percent of Americans (166 million people) are living paycheck to paycheck.

What’s more, 51 percent of Americans earning more than $100,000 per year reported living paycheck to paycheck in 2022.

Perhaps most alarming is the fact that this disturbing trend is getting worse as the Biden administration refuses to reverse course on its destructive economic agenda. Per the report, in 2022, “9.3 million more consumers are now living paycheck to paycheck, and eight million, or 86%, of those consumers earn more than $100,000 annually.”

According to Lending Club Financial Health Officer Anuj Nayar, most consumers blame inflation as the source of their financial tough times. “The effects of inflation are eating into every American’s wallet … While the number of Americans living paycheck to paycheck is close to the height we saw in the middle of the pandemic, the causes appear to be very different, as the economy is not sheltering in place like it was back in 2020.”

In other words, Biden’s wild spending spree, which now stands at $4.8 trillion in “new” spending in less than two years, is the primary reason Americans are struggling to make ends meet.

Based on the survey data, most Americans do not believe things will get better any time soon. In fact, only four out of 10 Americans “expect their personal finances to improve in the next year.” And, “90% of wage-earners report that their pay increases were lost to inflation in 2022, with only 42% expecting rising pay to offset price increases in 2023.”

Accordingly, most in the paycheck-to-paycheck cohort “are likely to shy away from large purchases in 2023, such as electronics and appliances.” Specifically, “only 35% of consumers said they will incur leisure travel expenses in 2023, and just 24% plan to purchase expensive electronics or appliances this year.”

When Americans spend significantly less on goods and services, GDP craters. When GDP falls for two consecutive quarters, we have a recession. Recessions, in turn, lead to job cuts (which are already taking place throughout the economy), which means even less consumer spending. This vicious cycle is what leads to economic calamities, commonly referred to as “depressions.”

It has been nearly a century since the Great Depression wreaked worldwide havoc. While the circumstances of the looming economic crisis are not exactly similar to the years leading up to the Great Depression, that is certainly not reason for optimism.

As of this writing, the national debt has reached a mindboggling $31.5 trillion and counting. Today, the national debt to GDP ratio, a good gauge to measure a nation’s macroeconomic health, has eclipsed 120 percent.

For comparison sake, in 1929, on the eve of the Great Depression, the nation’s debt was a paltry $17 billion and the debt to GDP ratio was a minuscule 16 percent.

Now, this does not automatically mean that the United States is teetering on the brink of another Great Depression. However, it is absolutely a sign that we are living in a totally unsustainable economic order.

As the recent Lending Club survey demonstrates, Americans are addressing their valid concerns about rising prices by tightening their belts and cutting unnecessary spending. So, when will Uncle Sam follow suit and rein in the out-of-control deficit spending that is causing the inflation in the first place, and putting our national economy in dire jeopardy?

Thankfully, the latest debt ceiling negotiations present an opportunity for Congress, which controls the nation’s purse strings, to put an end to this inflation-fueling, deficit-fattening spendathon.

While I am not naïve enough to believe that Congress and Biden will actually reduce the deficit, I am somewhat hopeful that the GOP-led House will at least leverage their position to quash Biden’s hopes for even more profligate spending over the next two years.

As the first law of holes states, “If you find yourself in a hole, stop digging.” That sentiment has obviously resonated with the American people over the past few years. Now, more than ever, it is time for the federal government to do the same.

Chris Talgo ([email protected]) is editorial director at The Heartland Institute.

Join the conversation as a VIP Member