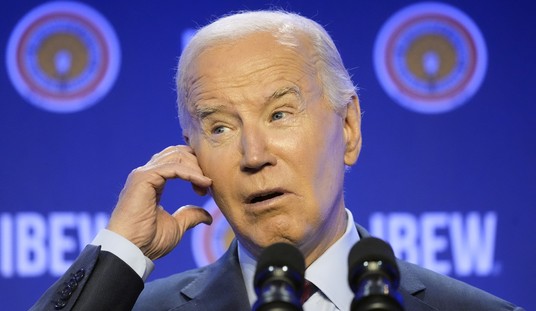

Unfortunately, each of us has been reminded over the last three years of ways in which poor U.S. government policies can negatively impact our pocketbooks. When we think about what we pay for the things that we need to live - from food to clothing, gasoline to electricity, and just about everything else - we realize that we are paying a lot more for those things today than we were paying just three or four years ago.

Although most of us are not economists, we do keep up with current events enough to know that these price increases are a result of inflation. We also understand that this record inflation was brought about by misguided government policies, to state it charitably. When times are good, we tend to forget just how much government policies can impact our lives, either positively or negatively. However, when we live through a situation like this current period of high inflation, we receive a painful reminder.

As agonizing as our current inflation-driven crisis may be, there is another far worse situation on the horizon. If not confronted, this will make our present hardships seem as if we are currently living on Easy Street. Like inflation, this is something that is government-driven. Where this differs, though, is that we will not be able to trace its roots to a single president and/or political party. It is a problem that has been building for many years in times when both Democrats were in charge of D.C., and when Republicans have been in charge as well.

What is this potential problem that is silently growing and threatening to overwhelm us? It is our national debt. It is similar to a silent cancer that is eating away at our country. I intentionally chose to compare our debt to this horrible disease because I have had two separate battles with it myself. Through the grace of God and the work of some great doctors, I am still here to talk about it.

Cancer has the potential to unknowingly be at work within our bodies for quite some time. A person may be able to continue functioning as normal in their daily life until a time comes when they notice that something is just not right, so they then decide it is time to see a doctor. If that person is fortunate, as I have been, the diagnosis comes in time for the doctors to put a lifesaving treatment plan into place. This treatment plan almost always involves either removing it, attacking and killing the cancerous cells, or some combination of the two. Although the options to fix the problem are sometimes unpleasant, they are far superior to the choice of doing nothing.

Our national debt has been a “silently growing disease,” reaching over $32 trillion without any signs that anything was wrong - until recently. However, just as people with a disease eventually tend to recognize warning signs, we now have glaring evidence that something is terribly wrong with our debt. To illustrate this point, let’s take a look at how the debt is directly impacting you and your family.

In early September, the Congressional Budget Office (CBO) posted their latest projections of U.S. deficits for the next several years. One figure that caught my attention in their 2024 numbers was the projection that the interest we pay on the debt next year will be $993 billion. When I saw this, I thought about the fact that much of this money will go to foreign countries that hold a significant amount of our debt. I also began to ponder how much money this would cost each U.S. taxpayer next year and decided to find the answer.

From a Pew Research study released in April 2023, I learned that 168 million tax returns were expected to be filed during the year, and that about two-thirds of those returns (or roughly 112 million) would show some taxable income. Since the 112 million figure seemed to represent taxpayers from the Pew perspective, I decided to use that number, and from there, the calculation was easy.

If you take $993 billion and divide that by 112 million taxpayers, you learn that the average taxpayer’s share of the interest on the debt for next year will be $8,866. Let that sink in for a minute. The government is going to spend $8,866 per taxpayer next year for interest alone. Not only will none of this money help pay down the debt, CBO estimates the government will add another $1.6 trillion of debt on top of that. This means that the amount of interest per taxpayer will likely only grow the following year and each year into the future, perhaps significantly, unless we stop running up debt.

Although we are using an average number that, by definition, will apply differently to each taxpayer, you get the point. Imagine if we had no federal debt, then you and your family could potentially keep almost $8,900 in your pocket next year because there would be no interest to pay. Even if it was less, say $4,000 or $2,000, wouldn’t that make a difference in your life? I believe the answer for most would be a resounding YES!

It is not uncommon for government accounting organizations, such as CBO, to state that our current budget trajectory is “unsustainable.” Even our government admits that we are literally living on borrowed money and borrowed time unless we get serious and force our politicians to limit spending. My team and I are constantly putting out information and ideas on ways that we can hold our politicians accountable and attack this problem. Please visit JoeFromTexas.com to learn more about how you can join us in this effort.

Joe Penland Sr. is the founder and chairman of Quality Mat Company – one of the oldest and largest producers of rig, oilfield and crane mats in the world. Joe has extensive banking experience having served on several bank boards for over 25 years. Joe lives North of Beaumont in Hardin County Texas, with his wife Linda. He believes in God, family, and the United States of America.

Join the conversation as a VIP Member